As Humphrey Bogart once said: “Well everybody in Casablanca has problems. Yours may work out.” The current market has us all feeling this way. We must find the way to the light.

Among the myriad factors affecting markets are the Fed, the war in Ukraine, ultra-high inflation, rising rates including mortgage rates, lack of housing supply, climate change challenges including scarcity of water in the West, equity market volatility, elevated energy prices, and jobs that go begging.

On the more positive side, incomes are growing, earnings are strong, economic activity continues apace, and people can find jobs.

Despite the positives, the fear factor that is most prominent is the imminent looming danger of a recession. Whether the Fed be able to manage the tightening so well that a recession would be avoided is foremost in mind. The GDP decline of 1.4% is being dismisses as a one-off. If more were to follow the worry indicator would climb.

By now, most pundits agree in principle and Chair Powell recently reinforced that there will probably be a move of 50 basis points at the May 3-4 meeting. Some have suggested 75 basis points may be in order. The future expectation is that rate hikes will be with us for the near future. The unwinding of quantitative easing will also be a factor in the months to come that so far have not appeared to unsettle markets.

Until the war reaches a negotiated cease fire, the uptick in energy prices is bound to stay with us for some time. Even with a modicum of relief from select states at the pump, the level of gas prices is not sustainable over the long haul. Is someone going to go to work at a $15 an hour job when it costs them $5 in gas to get to the job. At $105.35 per barrel, the direction is towards the recent $115 high mark.

On the fiscal policy side, there is some chatter about reviving a form of Build Back Better. We have not heard much about this topic lately, but the mid-term elections are just months away. If anything would pass it will be greatly scaled back from initial indications.

Concomitant with the idea of more fiscal spending comes the idea of tax increases. Even if the increased rates are targeted to the high end, many are not sanguine on the idea. Realism must prevail about what can be accomplished. Republicans are clearly united in their opposition to higher taxes. Any proposal that has a chance of passing would be with the rule of 51. We would also be displeased to see higher tax rates have an ill effect on economic growth.

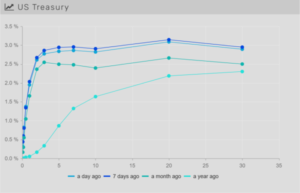

Wild ride in rates ends little changed WoW, but rough month overall for bond holders

April was another month bond holders would like to forget. Despite the heavy risk off tone based on fears monetary tightening will lead to lower global growth rates, they managed to climb back to recent highs. The middweek rally saw the curve bull-steepened with 2, 5, 10, and 30yr treasuries rallying -24, -24, -19, -13bps respectively.

The back end of the week saw rates recover to relatively unchanged as the Fed’s main inflation gauge reminded investors that the Fed is on a steady path of hiking rates, with a full +50bps coming next week. For the month of April, the curve steepened with 2, 5, 10, and 30yr rates higher +32, +43, +50, and +45bps respectively MoM.

Municipal revelations from John Hallacy

Many in the past have viewed the municipal market during stressful times as a place to hide out and wait for improvements in other markets. This time is different in not subtle ways. The outflows from the mutual funds have been recurring now for weeks with the latest outflow of $2+ billion. Many investors may be able to profit from the weakness in the market as levels back up and more value come to the fore.

The yield curve is quite flat at present. Investors are being compensated well on the short end. Given the prospects for higher rates, the long end is really the bailiwick of the institutional investor. The negative returns for the YTD are deep. It would be encouraging to see some investors extending but the added income would not be enough compensation for the prospective valuation hit in this environment.

The negative tone has not dissuaded issuers from tapping the market. One of the heaviest weeks of issuance for the year to date has been this last week. More volume should serve to drive yields higher and provide investors an opportunity to pick their spots of interest on the curve.

Issuance for the YTD is approximately $134 billion versus $150 billion for a decline of 10.2% in volume. Most strategists coming into the year were forecasting higher volume. But no one could have predicted the war, the move in oil prices, and the greater volatility in general. The federal infrastructure spending has not appeared to lift municipal issuance all that much at this point. There remains the possibility that volume will still be positively affected at some point once the construction activity has advanced even more over the summer months.

A handful of states have been issuing more on a YTD basis including GA, HI, KY, MI, SC, VA, and DC and Guam. College and university issuance is one of the few sectors that have experienced greater issuance. This sector has an affinity for taxable issuance, but the tax exemption has more appeal in a rising rate environment.

We look forward to the Fed’s decision next week and what are likely to be the probable outcomes and effects on markets.

Recent Comments